Description

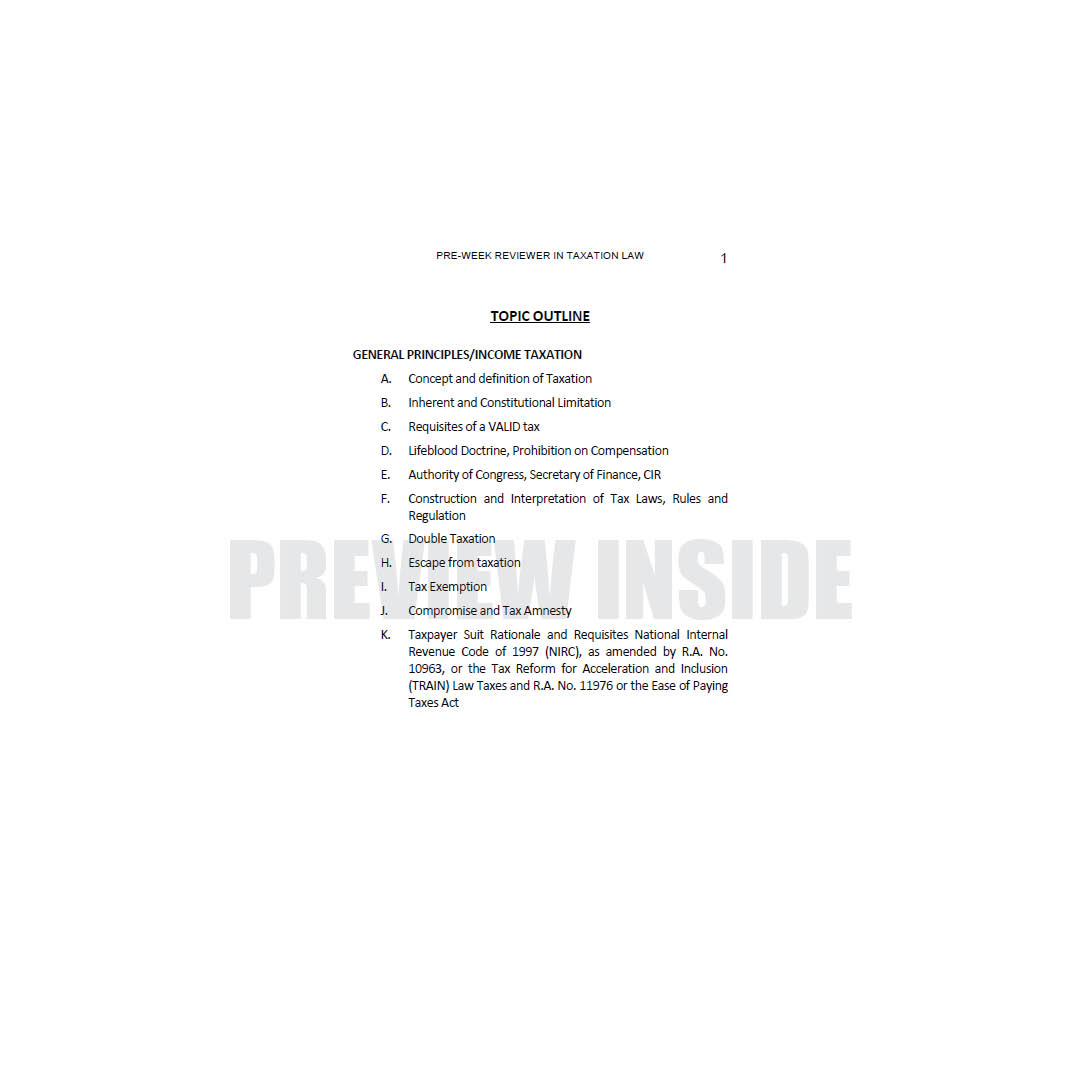

TOPIC OUTLINE

GENERAL PRINCIPLES/INCOME TAXATION

A. Concept and definition of Taxation

B. Inherent and Constitutional Limitation

C. Requisites of a VALID tax

D. Lifeblood Doctrine, Prohibition on Compensation

E. Authority of Congress, Secretary of Finance, CIR

F. Construction and Interpretation of Tax Laws, Rules and

Regulation

G. Double Taxation

H. Escape from taxation

I. Tax Exemption

J. Compromise and Tax Amnesty

K. Taxpayer Suit Rationale and Requisites National Internal

Revenue Code of 1997 (NIRC), as amended by R.A. No.

10963, or the Tax Reform for Acceleration and Inclusion

(TRAIN) Law Taxes and R.A. No. 11976 or the Ease of Paying

Taxes Act