Description

This current book, TAXPAYER’S GUIDE, still revolves around the common processes underlying tax compliance. These processes, generally covering registration, filing and payment of tax, address the tax obligations of the Filipino taxpayers. However, due to the breadth of the subject matter, the author has limited her discussion to income tax, business tax and withholding tax which are the taxes generally encountered by the taxpaying public.

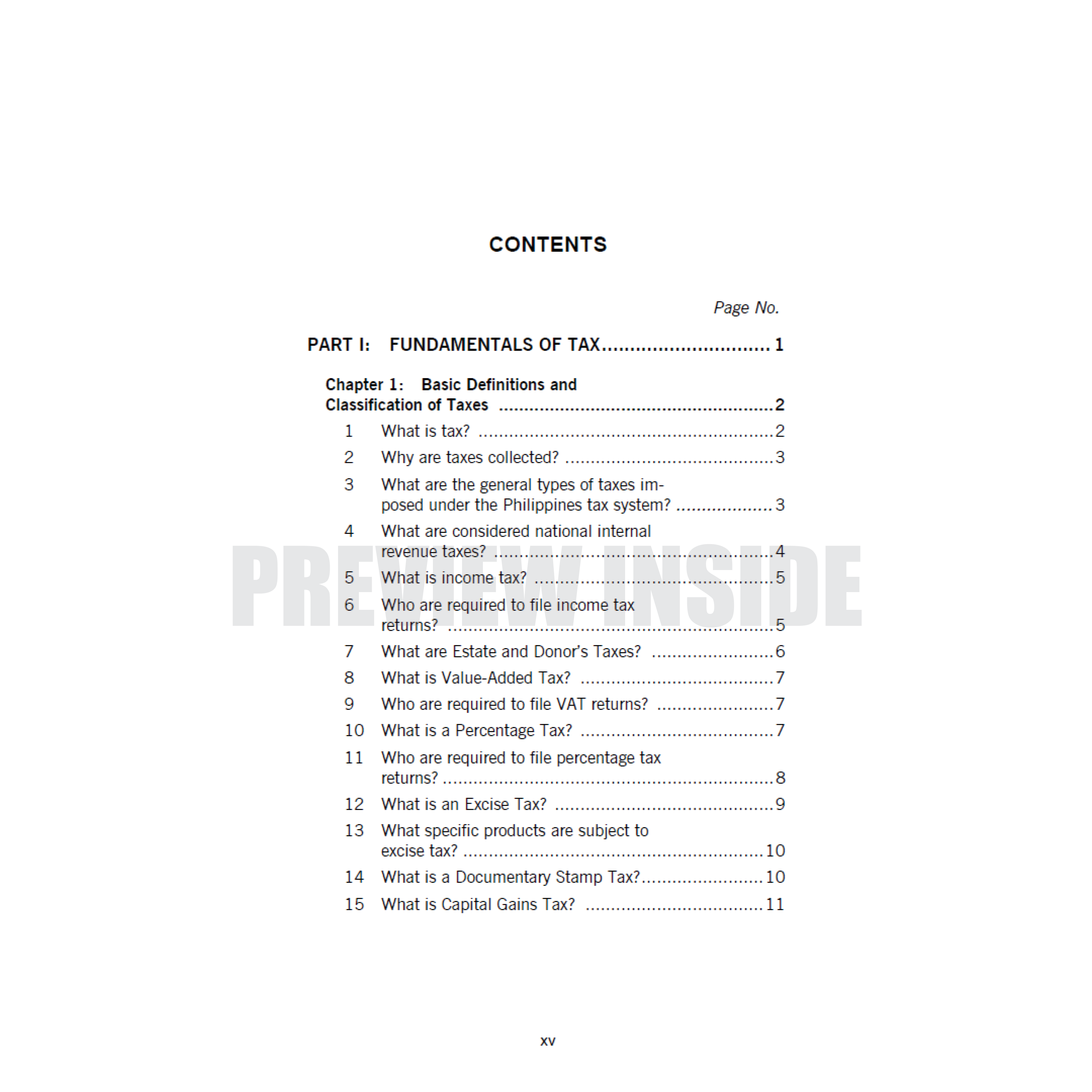

Structured on a Question-and-Answer (Q & A) format with illustrative examples, the book is divided into three (3) parts:

Part I discusses the fundamentals of tax. Falling under Part I are Chapters I to IV treating the definition and types of taxes, their implementing agencies, etc.

Part II outlines the basics of tax compliance following the Register–File–and–Pay (RFP) module of the BIR, and falling thereunder are Chapters V to VII which define in a more detailed manner the RFP module.

The final part, Part III, consisting of Chapters VIII to X, discusses common issues and concerns of taxpayers regarding tax assessment and investigation, refund of taxes and tax exemption.

The book is an attempt to treat the topic of tax in a simple, layman-friendly fashion in order to impart the importance of tax compliance. This is not an academic or a highly theoretical guide but a practical handbook. It draws substantial reference materials from the BIR website (www.bir. gov.ph) which is quite useful. Its added value is found in the selected problem situations that illustrate the subject of tax compliance, its remedy aspect and general guiding principles.